The DJIA got to 119 points up and closed almost 130 down.

S&P 11.58 up, close 13.61 down.

First up, MoneyBeat:

Sigh.

We’re suckers for streaks here at MoneyBeat, and the one that was just snapped was a goodie.

The Dow is now riding a three-day losing skid, capped by today’s 126-point drop, marking the first time this year the blue-chip average has suffered three straight down days.From Advisor Perspectives:

With it all said and done, the Dow went 112 trading days without a three-day losing streak, the longest such stretch in its history. The previous record was set in 1935, when the Dow went 93 trading days without three straight down days....MORE

S&P 500 Snapshot:

Poised on its 50-Day Moving Average

...In yesterday's 500 snapshot I speculated that the 50-day moving average could be a "potential trampoline" for the index. Today's low of 1610.92, hit about 40 minutes before the close, was less than half a point from the 50-MA. The index closed the day fractionally off its low with a loss of 0.84%. It's down 1.88% for the week so far.

Here is a 15-minute look at the 3-day downer.

Today's selling was reasonably orderly with volume 12% below its 50-day moving average.

The S&P 500 is now up 13.06% for 2013 and 3.40% below the all-time closing high of May 21....MOREFinally, from Slope of Hope

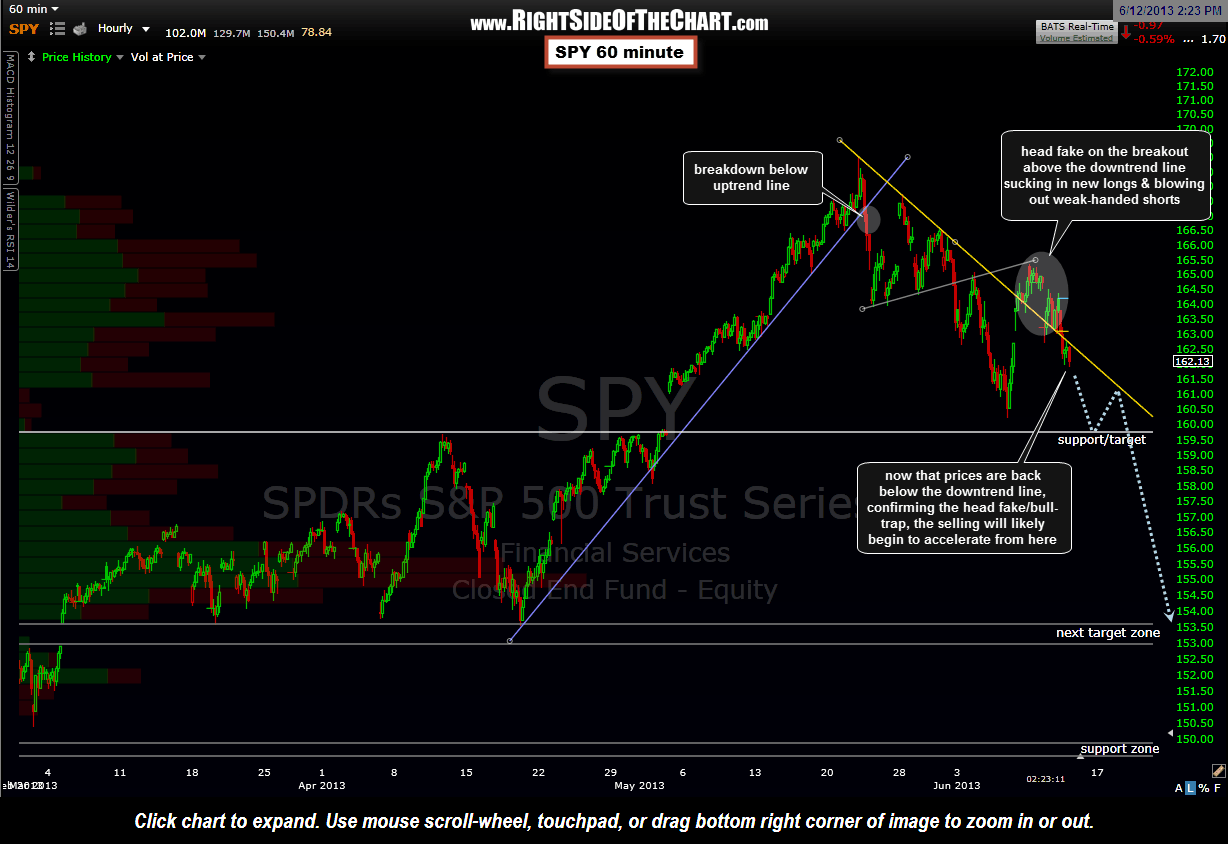

The Head Fake

...In financial markets, a head fake is where the market appears to be moving in one direction but ends up moving in the opposite direction. For example, the price of a stock may appear to move up, and all indications prior to that are that it will move up, but shortly after reverses direction and starts moving down.