"Disposable Income and the Stock Market"

From CXO Advisory:

A reader asked: “Is disposable income a leading indicator of the

stock market?” Arguably, an increase in disposable income would lead to

growth in consumption, corporate earnings and stock valuation. The

Bureau of Economic Analysis releases seasonally adjusted Disposable Personal Income (DPI) monthly with a lag of about one month via Line 27 of Table 2.6, “Personal Income and Its Disposition, Monthly.” Using this series for January 1959 through May 2013 and contemporaneous monthly levels of the S&P 500 Index (through June 2013), we find that…

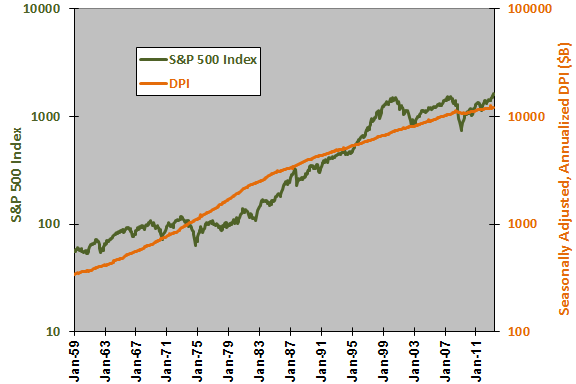

The following chart compares the behaviors of the S&P 500 Index

and DPI, both on logarithmic scales, over the entire sample period.

Although both series generally rise over time, the large mismatch in

volatilities makes it very difficult to discern any exploitable

relationship between them.

For a closer look, we relate monthly changes in the two series.

The next chart shows Pearson correlations for various lead-lag

scenarios between monthly changes in DPI and monthly S&P 500 Index

returns, ranging from the stock market leads DPI by 12 months (-12) to

DPI leads the stock market by 12 months (12), both for the entire sample

period and a recent subperiod. Correlations are small and noisy, with

little or no evidence that either series materially leads the other....MORE