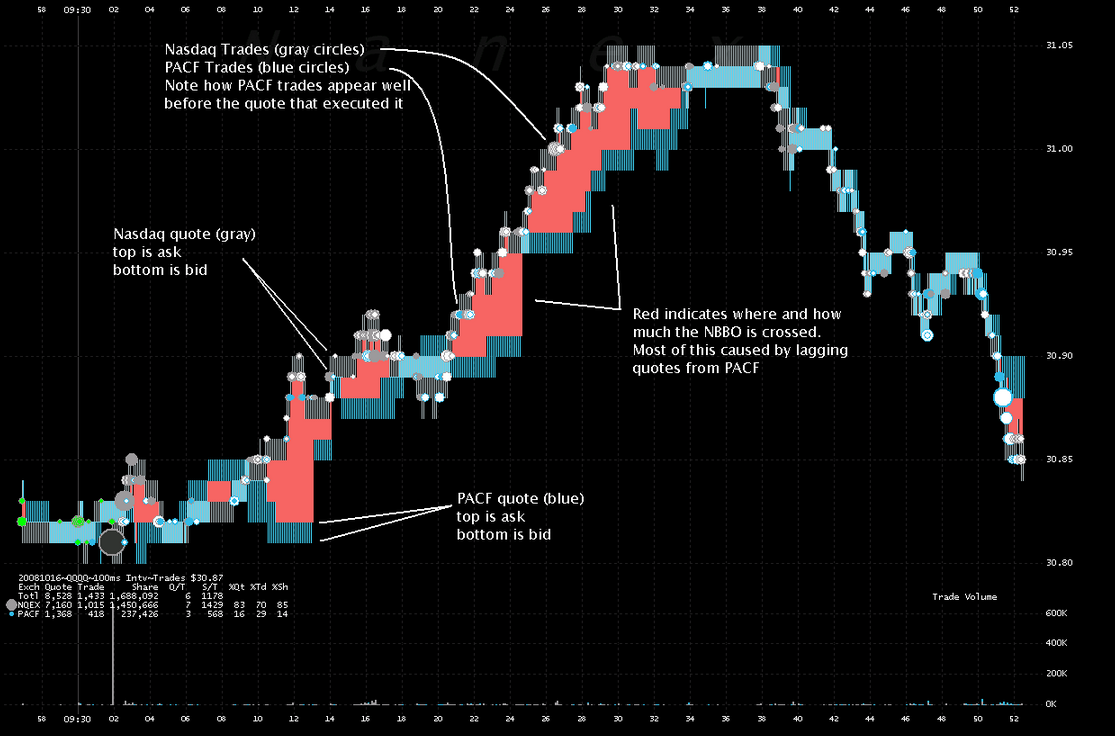

Wherever you see red in the charts below, that’s when HFT received an unfair trading advantage and front ran other traders and investors.

Click through, scroll down a bit, then hit start for samples of HFT front running

Source: Nanex

...MORE, including discussion by Nanex.

To my mind quote stuffing is even more egregious and should be easier to stop. From last August:

Dear Mary Shapiro: HFT and the Act of '34

I am familiar with the '33 and '34 Acts but have never thought of them in reference to High Frequency Trading. If the facts are as presented, Ms. Shapiro and the rest of the commissioners are derelict in their duties and should be replaced.Ms. Shapiro never got back to me. In March I tried to be more helpful:

That said they can't be as clueless as former Chairman Christopher Cox.

(can they?)

From The Market Ticker:

HFT Mess -- A *SIMPLE* Answer

I know I've said it before, but it's time to rehash the HFT debate....

...Further, The Securities Act of 1934 tells us that all means by which one may manipulate prices are illegal. Period. The law is clear on this point:

(2)To effect, alone or with 1 or more other persons, a series of transactions in any security registered on a national securities exchange, any security not so registered, or in connection with any security-based swap or security-based swap agreement with respect to such security creating actual or apparent active trading in such security, or raising or depressing the price of such security, for the purpose of inducing the purchase or sale of such security by others....

In the U.S. we have the Securities and the Securities Exchange Acts but nobody pays any attention to them.*...

...*The U.S. law is pretty straightforward, it says your 'puter can't spoof my 'puter but for whatever reason the SEC has chosen to not enforce it.

15 USC § 78i - Manipulation of security prices

This subchapter may be cited as the “Securities Act of 1933”.

(a) Transactions relating to purchase or sale of securityAnd from the '34 Act:

It shall be unlawful for any person, directly or indirectly, by the use of the mails or any means or instrumentality of interstate commerce, or of any facility of any national securities exchange, or for any member of a national securities exchange—(1) For the purpose of creating a false or misleading appearance of active trading in any security other than a government security, or a false or misleading appearance with respect to the market for any such security...

Securities Exchange Act of 1934, Section 9 -- Manipulation of Security Prices...

And as far back as 2011: "Fighting Fire With Fire: Beating the High Frequency Traders at Their Own Game".