From the FT's BeyondBrics blog:

By Diana Choyleva, Lombard Street Research

China’s first corporate bond default in recent history is only the

first step on a difficult road of reform. Much like the removal of the

floor under the bank lending rate last year, allowing the default of

Chaori Solar Energy Science and Technology Co. was the easy part.

It has been dubbed China’s ‘Bear Stearns moment’ by some and its ‘Lehman moment’ by others. It is likely to be neither.

Unlike Bear Stearns, Chaori’s default did not change the market’s

perception of inherent credit risk in the economy, causing a liquidity

crunch. Everyone knew Chaori had been in trouble for some time. Nor is

it a replay of Lehman’s collapse, which triggered a panic partly because

it introduced uncertainty about the US government’s intentions.

Unfortunately, letting Chaori default does not tell us whether Beijing

will let the market decide who will fail.

But China’s ‘Bear Stearns moment’ could be just around the corner.

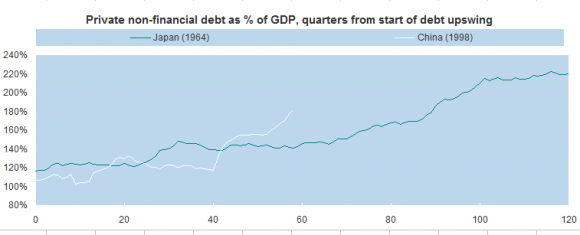

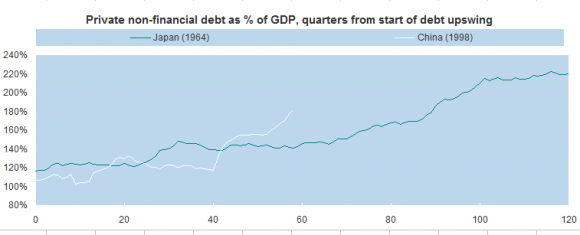

Overall debt in the economy has surged over the past five years,

reaching over 238% of GDP in 2013. That is not yet excessive by

international standards. Even assuming half of household and net

non-financial sector debt is bad and zero is recovered, the government

could take the liabilities explicitly onto its balance sheet and its

gross debt would still be ‘only’ 100% of GDP.

Doubling the government’s debt would be manageable if Beijing were to

clean up the banks properly and turn them into market-driven

institutions. After two to three years of heightened financial market

distress and below 5% real GDP growth, the economy would be able to

resume a decent catch-up growth rate of 5% a year, even maybe more....MORE