And/or in both cases Izabella Kaminska was the one pointing out the instant case.

From Wednesday's FT Alphaville:

This is nuts. When’s the crash?

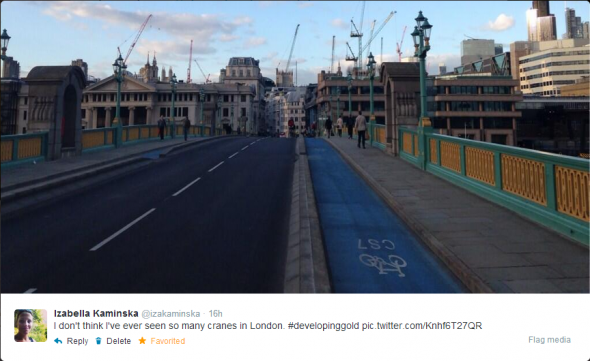

Okay, maybe it’s because this particular FT Alphaville blogger has been safely quarantined in Geneva, Switzerland for the last two years where everything is frozen in time, and it’s all down to “London shock”, but it really does feel like you can’t walk three foot in the capital these days without bumping into a crane panorama that would make the Doozers of Fraggle Rock proud.

Case in point, the current view from outside FT Towers at One Southwark Bridge....MORE

And from today's FTAv:

Let them eat Bitcoin mining rigs

...And here are BitStamp Bitcoin prices (via Bitcoin Charts):

But the trouble could also be indicating a more serious problem, that of over-investment and misallocated resources more generally. This is also something the Bitcoin community might not have accounted for due to the mining protocol’s nifty correction mechanism for over or under mining.....MUCH MORE