Drawing Hands M.C. Escher, 1948

Rally Monkey gets sucked into the self-referential vortex of psychologically important thresholds

From FT Alphaville:

All aboard the US$ flow merry-go-round!

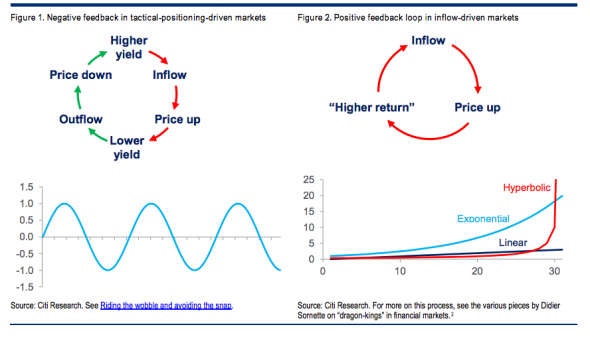

Money managers have been stung hard this year due to US government bonds not performing the way their traditional mean-reverting strategies suggested they would. Taper was supposed to imply sell-off. That didn’t happen. And now everyone is trying to understand why not.

At FT Alphaville we’ve presented the flow explanation on a number of occasions. The theory is that taper talk prompts dumb money to sell safety, and the smart money — which knows there’s no such thing as underpriced principal safety these days and that taper implies risk-off — to pile into safety at an even faster rate.

In this theory the whole process is then exacerbated by a feedback loop. Sellers of safety buy risky assets, like emerging market debt, instead. But the sellers/issuers of that debt then recycle that cash back into safe US dollar securities, rather than goods or services in the emerging market. So every risk-on signal from the Fed only ends up creating more buyers for dollar denominated bonds.

Which means for the cycle to stop, those getting their hands on risk flows need themselves to reinvest in real equity risk — problematic if you happen to be an internet company with too much cash on your balance sheet already — or actually go spend the cash on dollar denominated goods and services.

Matt King over at Citi has noted the flow-based vicious circle of it all.

As he explains in a note on Friday the phenomenon creates a self-enforcing feedback loop which changes the nature of value relationships:

As King notes:Possibly also of interest:

In markets dominated by such positive feedback loops, most of the time you want to go with the flow, to buy the dip. The flows have a momentum to them which can persist in spite of traditional valuation metrics having been exceeded – all the more so when active managers decide that they too need to go tactically long in anticipation of the inflows continuing. Every so often, though, such systems are subject to an abrupt and often unpredictable transition. Just think of the price action in gold last year: one minute it was everyone’s favourite asset, that you were “structurally underweight” despite all traditional valuations having been exceeded. The next, investors were wondering why they’d bought so much of an asset they didn’t understand which didn’t pay them nearly enough yield, and which even though it had sold off a lot they had way too much of....MUCH MORE

"Why strange loops could be an argument for artificial intelligence"