A major caveat for investors trying to hedge inflation with equities: they aren't that correlated once inflation goes above 4% or so. 0-to-4% is the sweet spot. Above 4% you don't want services companies, manufacturers with tangible assets are the place to be.

This is one reason the Berlin market was able to approximate (with a 3-6 month lag) the Weimar hyper-inflation (the other being survivorship bias). The companies the historians track, the big brewers, metalworkers, miners had real assets.

Stocks of service companies without near-monopoly pricing power got crushed like any other long dated asset.

This is a point you won't see anywhere else, at least until the information contained in those dusty old german-language records gets translated....More after today's headline story from FT Alphaville:

Stocks are basically bonds where the coupons tend to grow faster than the level of consumer prices. That makes equities sound like a great thing to own if you’re worried about inflation, and, in fact, Mr Stocks-for-the-Long-Run made this case a few years ago. While the actual article is more nuanced than the headline and opening paragraph would suggest — he admits that stocks only become immune to inflation over multi-decade periods — it’s still a bit misleading. The last time the rich world had to deal with meaningful inflation, it was bonds that beat stocks.

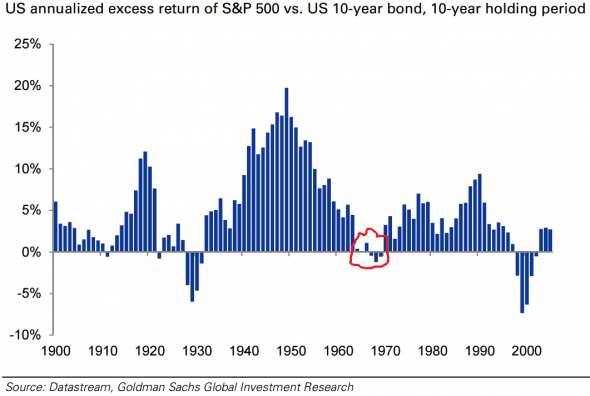

We’re reminded of all this because of two striking charts from a new report from Goldman Sachs on the implications of negative, long-term real interest rates. Consider the following chart, which compares the returns you would have gotten from buying and holding US stocks versus US 10-year bonds over decade-long periods:Crestmont Research has some of the best graphics on the various correlations. From "The Inflation-P/E Ratio Connection in One Chart":

If you had known that the US was about to experience a long period of accelerating inflation, would you have bet on US Treasury bonds over US corporate equities? It certainly doesn’t seem like the right plan, and yet it would have made you money for a surprisingly long time. Stocks were so expensive in the late 1960s that bonds ended up doing okay, at least until Volcker, despite the significant upward drift in interest rates....MUCH MORE

......

....MORE

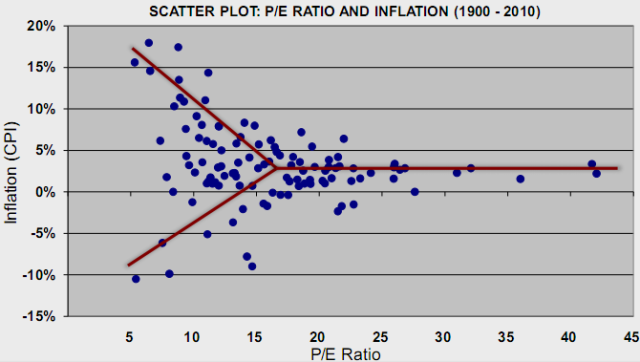

From "Crestmont Research on Inflation, P/E's and Market Returns":

Here's another way to look at the relationship between inflation and P/E's. Note that both the highest inflation and deflation rates correspond with the lowest multiples accorded the earnings:

...MORE

Finally, to reiterate:

A subject near and dear. The sweet spot for P/E ratios is 1.00- 2.00% annual CPI inflation. As you move away from that in either direction multiples drop off pretty fast, to the point that equities are not an optimal investment. You won't believe what the best investments for inflation in the 8-12% and greater than 100% ranges are. I'll write about them if we ever go Weimar....