If Contemporary Art Is So Great, Why Doesn’t Anyone Make Any Money?

The art business is booming, but many galleries are barely getting by. One German expert thinks he knows the answers

On Tuesday, the highly respected Wallspace gallery in Manhattan’s Chelsea neighborhood announced it would close its doors permanently on Aug. 7. The lease was up, and “it necessitated a reevaluation,” said Jane Hait, who co-founded the space with Janine Foeller. “It’s a particularly tough climate for people doing work that’s not necessarily super commercial.” The closure of such a celebrated fixture of the New York art scene underscores the fact that—despite the unprecedented avalanche of money blanketing the contemporary art world—it’s surprisingly difficult for galleries to make money.

The news of Wallspace’s closing comes just weeks before the English release of Management of Art Galleries, a slim, Day-Glo orange book that caused a furor when it was published in Germany last year.

Written by a 31-year-old German entrepreneur/professor/art adviser named Magnus Resch, the book argues that most galleries are undercapitalized and inefficient, and moreover, that with McKinsey-like business strategies (Resch went to the London School of Economics and the University of St. Gallen, in Switzerland), the entire art market could be turned into a profit-generating machine. “I could have just said, ‘The revenue numbers are terrible,’ but rather than being so negative I’m actually offering solutions,” Resch says in an interview. “It’s based on the analysis that I did.”

Under different circumstances, Resch’s claims would probably have been waved away, but in what’s close to a first for the gallery world, he has the data to back them up.

Last year, Resch sent out an anonymous electronic survey to 8,000 galleries, and more than 16 percent, or about 1,300 people, responded with information about their revenue, number of employees, and location. (The original version of the book included data for just Germany. The English translation includes data for the U.S., the U.K., and Germany.)

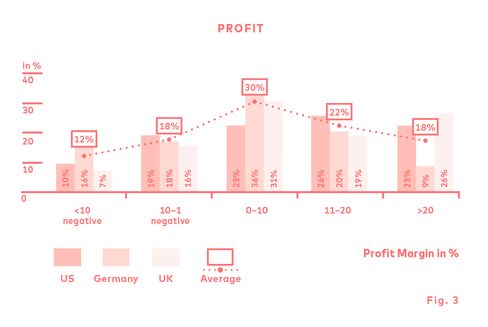

The results are grim: Fifty-five percent of the galleries in Resch’s survey stated that their revenue was less than $200,000 per year; 30 percent of the respondents actually lost money; and the average profit margin of galleries surveyed was just 6.5 percent. (Lest a critic argue that the pool was too skewed to rural galleries selling crafts, or decorative arts galleries buckling under the weight of their unsalable Louis XV chairs, 93 percent of Resch’s respondents represent contemporary art galleries.)...MORESee also:

Wildenstein: The Art World's Most Powerful Dealer Family

...an insular art-dealing dynasty whose $5 billion fortune, Gulfstream IV, racing stable, private Virgin Island compound, and 66,000-acre Kenya ranch cannot erase the rancorous legacy handed down from father to son to son....Commercialism As The Last 'ism' in Art: "Q4 Global Auction Report and Year in Review"

“Making money is art, and working is art and good business is the best art.”

-Andy Warhol

I stole the 'ism' line from dealer Michael Finley's 2012 book The Value of Art.

Just as Duveen hit one of his dealing career high points with Gainsborough's 'Blue Boy' Finley can lay claim to putting together the deal that transferred van Gogh's Portrait of Dr. Gachet.

Would You Like to Come Up and See Mein Klimt?