Here's the recent action via FinViz:

February $2.358 up 10.2 cents

We'll be back after the storage report on Thursday.

And from Bloomberg:

U.S. Gas Erases 25% December Loss on Outlook for Wintry Weather

It’s taken a bit of ice and snow, but U.S. natural gas traders finally are convinced that winter is here.

Gas futures are headed for the first monthly gain since June, wiping out mid-December losses of as much as 25 percent, after overnight computer models predicted colder weather would boost demand and may help ease a supply glut. Below-normal temperatures from the West Coast through Texas over the next 10 days will push across the Midwest Jan. 8 through Jan. 12, said MDA Weather Services. Unusually mild weather on the East Coast will retreat.

“The market is reacting to the shock that we are actually going to get this cold weather,” said Phil Flynn, senior market analyst at Price Futures Group in Chicago. “We had a record short position a few weeks ago and we had priced in absolutely no weather demand. The weather forecasts are continuing to get colder.”

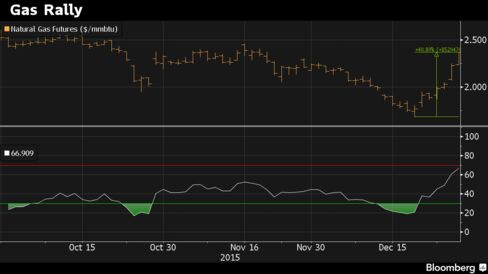

Gas futures for January delivery climbed 13.7 cents, or 6.2 percent, to $2.365 per million British thermal units on the New York Mercantile Exchange at 10:22 a.m. after rising to $2.374, the highest intraday price since Nov. 19. The futures are up 5.8 percent this month. The January contracts expire Tuesday.

Winter Weather

As much as 11.5 inches (29 centimeters) of snow piled up in parts of the upper Midwest since early Saturday, with 24 to 41 inches reported in Texas and New Mexico, and snow and sleet spread Tuesday across New York, New Jersey, New England and eastern Canada. The projected high of 38 degrees Fahrenheit (3.3 Celsius) in Chicago would be 6 degrees lower than the same day last week.

The change in forecasts showing cold weather hitting the Midwest and Northeast, the biggest consumers of heating fuel, was so unexpected that gas is now at risk of being overbought, given the sharp rally over the past week. The relative strength index, a technical price momentum indicator, surged to 66.8 at 10:18 a.m. after plunging to 19.4 on Dec. 17. A reading of 30 is considered by some traders to be a buy signal, or an oversold condition, while 70 may trigger selling....MORE

Natural gas RSI as of 10:30 a.m. Tuesday.