From Naked Capitalism:

This is Naked Capitalism’s special fundraiser, to fight a McCarthtyite attack against this site and 200 others by funding legal expenses and other site support. For more background on how the Washington Post smeared Naked Capitalism along with other established, well-regarded independent news sites, and why this is such a dangerous development, see this article by Ben Norton and Greenwald and this piece by Matt Taibbi. Our post gives more detail on how we plan to fight back. 23 donors have already supported this campaign. Please join us and participate via our Tip Jar, which shows how to give via check, credit card, debit card, or PayPal.

Yves here. By virtue of steamrolling local taxi operations in cities all over the world, combined with cultivating cheerleaders in the business press and among Silicon Valley libertarians, Uber has managed to create an image of inevitability and invincibility. How much is hype and how much is real?

As transportation industry expert Hubert Horan will demonstrate in his four-part series, Uber has greatly oversold its case. There are no grounds for believing that Uber will ever be profitable, let alone justify its lofty valuation, absent perhaps the widespread implementation of driverless cars. Lambert has started digging into that issue, and his posts on that topic have consistently found that the technology would be vastly more difficult to develop and implement that its boosters acknowledge, would require substantial upgrading in roads, may never be viable in adverse weather conditions (snow and rain) and is least likely to be implemented in cities, which present far more daunting design demands that long-distance transport on highways.

Tellingly, earlier this month, Bloomberg reported that JP Morgan and Deutsche Bank turned down the “opportunity” to sell Uber shares to high-net-worth individuals. The reason? The taxi ride company provided 290 pages of verbiage, but would not provide its net income or even annual revenues.

By Hubert Horan, who has 40 years of experience in the management and regulation of transportation companies (primarily airlines). Horan has no financial links with any urban car service industry competitors, investors or regulators, or any firms that work on behalf of industry participants.

Uber is currently the most highly valued private company in the world. Its primarily Silicon Valley-based investors have a achieved a venture capital valuation of $69 billion based on direct investment of over $13 billion. Uber hopes to earn billions in returns for those investors out of an urban car service industry that historically had razor-thin margins producing a commodity product. Although the industry has been competitively fragmented and structurally stable for over a century, Uber has been aggressively pursuing global industry dominance, in the belief that the industry has been radically transformed into a “winner-take-all” market.

This is the first of a series of articles addressing the question of whether Uber’s pursuit of global industry dominance would actually improve the efficiency of the urban car service industry and improve overall economic welfare.

For Uber (or any other radical industry restructuring) to be welfare enhancing, it would have to clearly demonstrate:

The ability to earn sustainable profits in competitive markets large enough to provide attractive returns on its invested capitalThe ability to provide service at significantly lower cost, or the ability to produce much higher quality service at similar costsThat it has created new sources of sustainable competitive advantages through major product redesigns and technology/process innovations that incumbent producers could not readily match, andEvidence that the newly-dominant company will have strong incentive to pass on a significant share of those efficiency gains to consumers.Unlike most startups, Uber did not enter the industry in pursuit of a significant market share, but was explicitly working to drive incumbents out of business and achieve global industry dominance. Uber’s huge valuation was always predicated on the dramatic growth towards global dominance. Thus if Uber’s valuation and industry dominance were to be welfare enhancing, Uber’s efficiency and competitive advantages would need to be overwhelming, and there would need to be clear evidence of Uber’s ability to generate large profits and consumer welfare benefits out of these advantages.

While most media coverage focused on isolated Uber product attributes, or its corporate style and image, this series will focus on the overall economics of Uber, using the approaches that outsiders examining industry competitive dynamics or investment opportunities typically would. This first article will present evidence on Uber’s profitability, while subsequent pieces will present evidence about cost efficiency, competitive advantage and the other issues critical to the larger economic welfare question.

Uber Has Operating Losses of $2 Billion a Year, More Than Any Startup in History

Published financial data shows that Uber is losing more money than any startup in history and that its ability to capture customers and drivers from incumbent operators is entirely due to $2 billion in annual investor subsidies. The vast majority of media coverage presumes Uber is following the path of prominent digitally-based startups whose large initial losses transformed into strong profits within a few years.

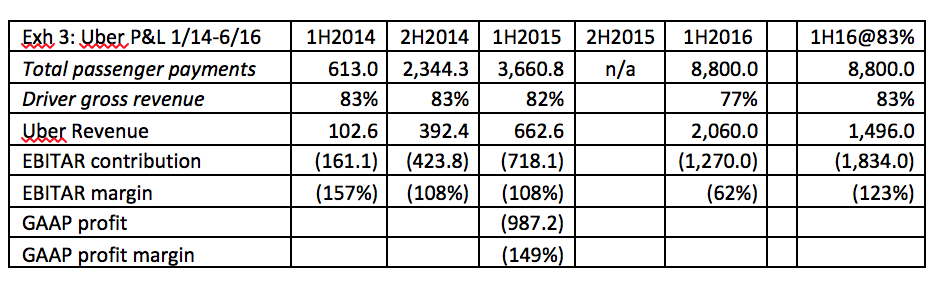

This presumption is contradicted by Uber’s actual financial results, which show no meaningful margin improvement through 2015 while the limited margin improvements achieved in 2016 can be entirely explained by Uber-imposed cutbacks to driver compensation. It is also contradicted by the fact that Uber lacks the major scale and network economies that allowed digitally-based startups to achieve rapid margin improvement.

As a private company, Uber is not required to publish financial statements, and financial statements disseminated privately are not required to be audited in accordance with generally accepted accounting principles (GAAP) or satisfy the SEC’s reporting standards for public companies.

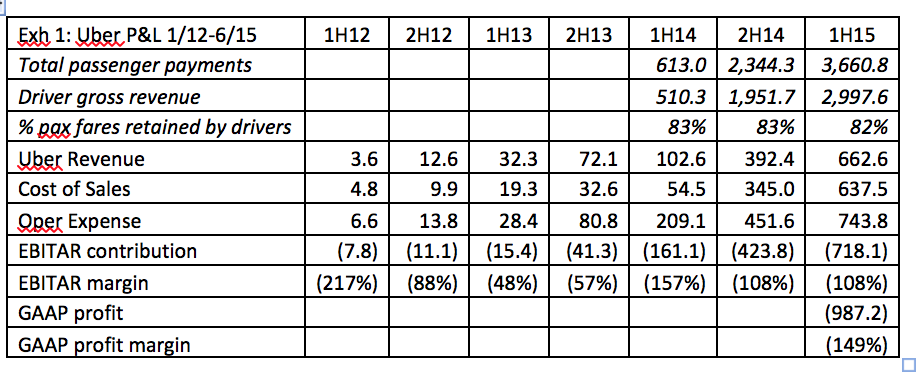

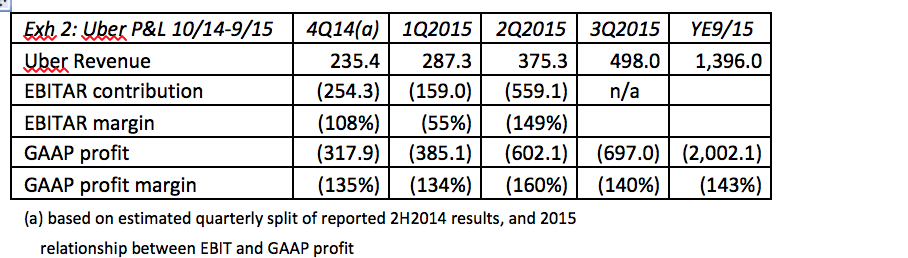

The financial tables below are based on private financial statements that Uber shared with investors that were published in the financial press on three separate occasions. The first set included data for 2012, 2013 and the first half of 2014, although only EBITAR (before interest, taxes, depreciation and amortization) contribution was shown, not the true (GAAP) profit that publically traded companies report.[1] The second set included tables of GAAP profit data for full year 2014 and the first half of 2015;[2] the third set included summary EBITAR contribution data for the first half of 2016.[3] There has been no public report of results for the fourth quarter of 2015.

Exhibit 1 summarizes data from 2013 through the first half of 2015. Drivers retained 83% of passenger payments (fares plus tips) which must cover the cost of vehicle ownership, insurance and maintenance, fuel, credit card and license fees as well as health insurance and take home pay; the balance is Uber’s total revenue. Exhibit 2 shows the GAAP results for the full year ending September 2015 based on the published numbers and an estimated quarterly split of published 2nd half 2014 results. Exhibit 3 compares first half 2016 results to 2014-15 results. There is no simple relationship between EBITAR contribution and GAAP profitability and even publically traded companies have wide leeway as to what expenses can be excluded from interim contribution measures such as EBITAR.

As shown in Exhibit 2, for the year ending September 2015, Uber had GAAP losses of $2 billion on revenue of $1.4 billion, a negative 143% profit margin. Thus Uber’s current operations depend on $2 billion in subsidies, funded out of the $13 billion in cash its investors have provided....MUCH MORE

Uber passengers were paying only 41% of the actual cost of their trips; Uber was using these massive subsidies to undercut the fares and provide more capacity than the competitors who had to cover 100% of their costs out of passenger fares.

Many other tech startups lost money as they pursued growth and market share, but losses of this magnitude are unprecedented; in its worst-ever four quarters, in 2000, Amazon had a negative 50% margin, losing $1.4 billion on $2.8 billion in revenue, and the company responded by firing more than 15 percent of its workforce.[4] 2015 was Uber’s fifth year of operations; at that point in its history Facebook was achieving 25% profit margins.[5]

No Evidence of the Rapid Margin Improvement That Drove Other Tech Startups to Profitability

There is no evidence that Uber’s rapid growth is driving the rapid margin improvements achieved by other prominent tech startups as they “grew into profitability.”...