This primer on what's what in Funding Land is as good as you are likely to find.

From Bloomberg via ZeroHedge, April 18:

It's Time To Pay Attention To Funding Risks Again

Authored by Simon White, Bloomberg macro strategist,

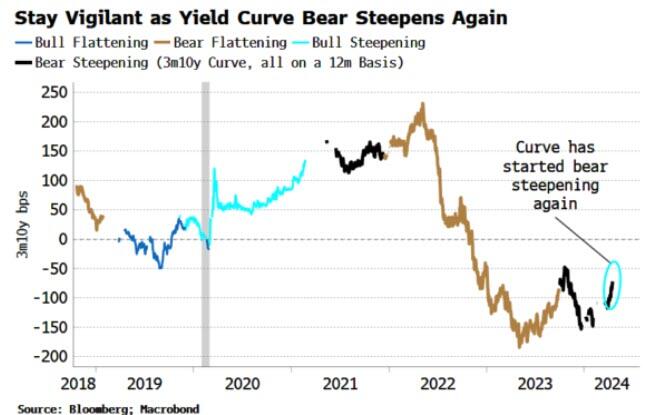

The

risk of a squeeze in US funding markets is increasing as the yield

curve bear steepens, i.e. longer-term yields rise more than short-term

ones. More attractive bill yields and climbing interest-payment

costs on government debt are depleting reserves and reducing their

velocity, increasing the chance of a disorderly upswing in funding

rates, as well as posing a risk to the stock market.

The bond market intimidates everybody, in the oft-cited words of Bill Clinton’s chief strategist James Carville. That description is apt today as rising yields reverberate across the financial system. Funding risks are intensifying again, increasing the chance of a rate-volatility driven correction in stocks.

Concerns about funding issues have been in abeyance for most of this

year, but it is time to sit up and take notice again as the backdrop

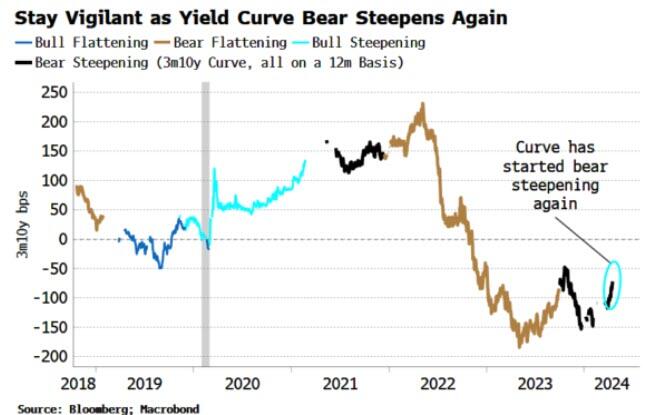

becomes more pernicious. The bear steepening of the yield curve

is a double whammy, accelerating the rate of reserve depletion through a

declining reverse repo facility (RRP) and rising government interest

payments.

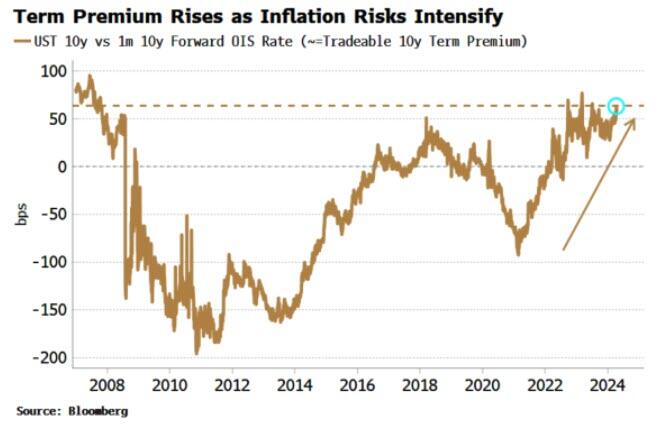

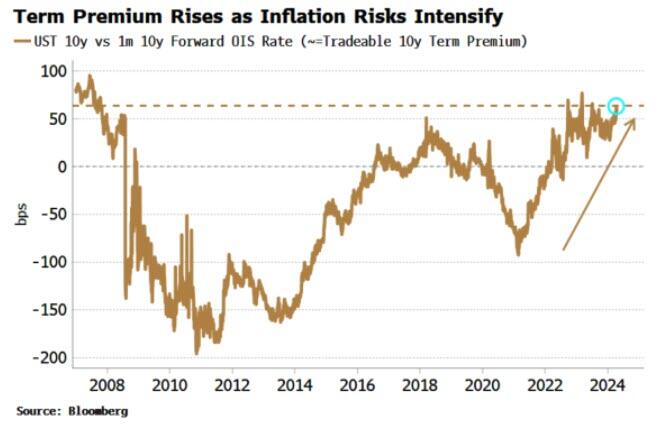

The

curve has been bear steepening in the 3-12 month versus 10-year sectors

as inflation fears drive term premium higher, with the measure now

close to levels last seen in 2008 (using tradeable forward OIS rates

rather than “academic” term premium).

A bear steepening is particularly problematic in the current set-up.

First

note that the RRP has been hugely important in keeping risk assets

supported despite the fastest rate-hiking cycle for decades and ongoing

QT.

The Treasury’s decision to pivot issuance toward

short-term bills allowed money market funds (MMFs) to tap the more than

$2.5 trillion liquidity idling in the RRP to fund the government. That prevented enormous public issuance crowding out other assets, and allowed the rally in stocks and bonds to continue.

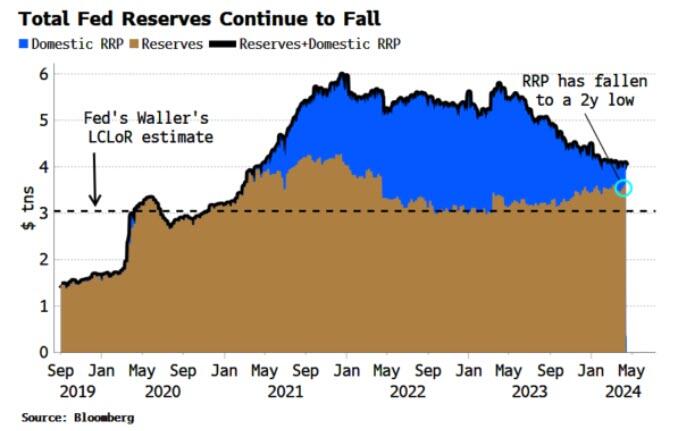

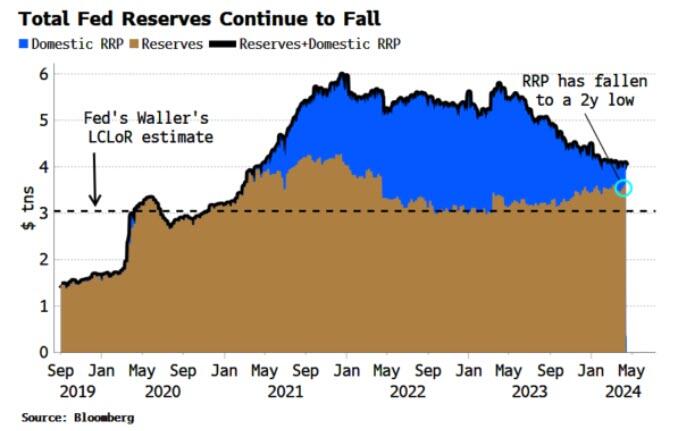

But

the RRP falling and eventually going to zero is a harbinger total

reserves overall are potentially nearing their so-called lowest

comfortable level — with estimates for the LCLoR ranging from about $2.5

to $3 trillion — where abrupt and acute funding problems become more

likely. This week the domestic RRP fell as low as $327 billion,

and is now at $440 billion, the lowest levels it has reached since June

2021, taking the sum of reserves and the RRP to just over $4 trillion.

The

RRP has been declining as six-month and 12-month bill yields have been

rising in response to the market reducing the number of rate cuts

expected from the Fed, making bills more attractive to MMFs relative to

the RRP facility.

Some of the RRP’s recent fall has also

likely been driven by seasonal tax payments. But that should not mask

the clear downwards trend in the facility and its rising volatility. It would not be the first time that a telegraphed non-risk becomes a real risk precisely because peoples’ guards are down.

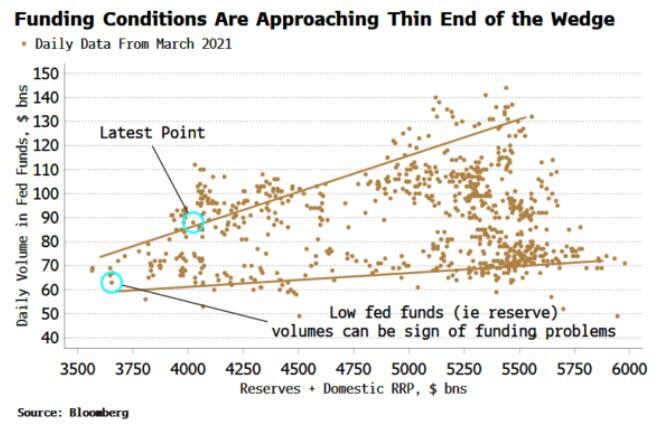

That’s potentially the case today. As I noted in a column earlier this year, a

portent of previous funding episodes was a sharp drop in funding

volumes immediately preceding a rapid rise in them, similar to a tsunami

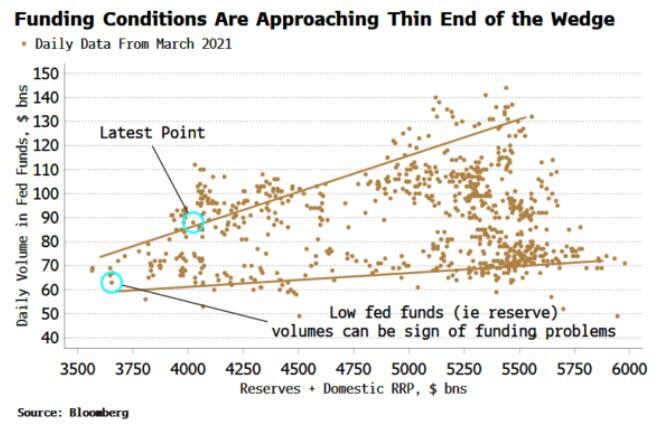

wave. As the chart below shows, when the total amount of

reserves + RRP declines, volumes in fed funds (i.e. reserves) tend to

also decline.

Further falls in fed funds volumes would be a sign that funding problems are potentially fomenting.

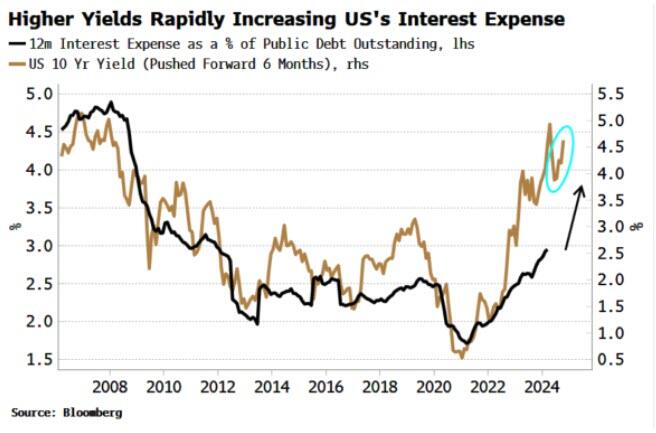

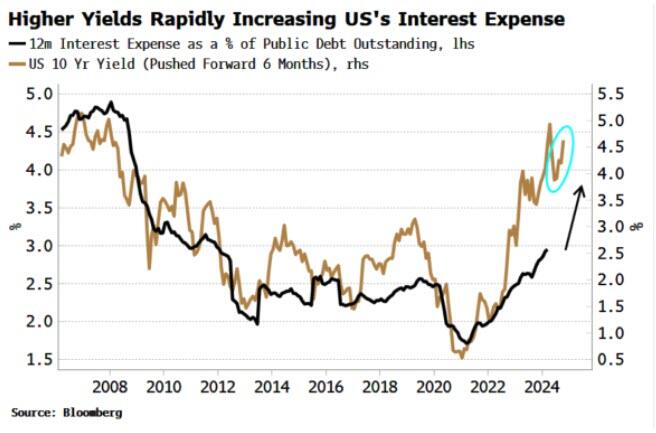

Rising

longer-term yields are the other side of the coin in the bear

steepening. The US government’s interest-rate bill is climbing rapidly,

and is now over $1 trillion on an annual basis. This is set to grow much

higher.

The 10-year yield gives us a near real-time

barometer for the US’s annual interest expense. The recent rise in

yields projects the expense will soon double to almost 5% of total debt

outstanding, or over $1.7 trillion - i.e. about the GDP of Australia each year in interest.

Here

lies the rub: to pay that interest, the government needs to tax and

borrow. But that is an ever-greater drain on reserves and their

velocity, accentuating the effects of the Fed’s ongoing QT program.

You might ask why that is the case given the interest is paid to bond holders and is therefore re-injected into the economy?

But that’s unlikely to be so for two reasons.

The

first is that the corporate and household sectors, the two most likely

to spend interest back in the domestic economy, together only account

for about 10% of UST holdings. The much larger financial and foreign

sectors are more likely to save the proceeds, or spend them abroad.

Second,

reserves that end up as savings are of lower velocity, especially if

they were originally higher-velocity bank deposits used to pay taxes.

The more that interest payments percolate through the system, the more

they end up with holders who have an increasingly lower propensity to

spend them.

Thus a bear steepening squeezes the RRP and outstanding

reserves — as well as their velocity — in a pincer movement, increasing

the risk of a funding episode.

The last such major

squeeze was in September 2019. It’s notable that in the days running up

to that, the yield curve was bear steepening (in fact, it was in the top

1% of eight-day rises for the 2s10s curve going back 2000).

The

bear steepening therefore means we should once again be vigilant to

funding risks, and keep a close eye on the Funding Stress Trigger shown

below....

....

MORE, as with Shakespeare's wasp, the sting is in the tail.

(

not going all Petruchio, not gonna go there)

These two points:

The

first is that the corporate and household sectors, the two most likely

to spend interest back in the domestic economy, together only account

for about 10% of UST holdings. The much larger financial and foreign

sectors are more likely to save the proceeds, or spend them abroad.

Second,

reserves that end up as savings are of lower velocity, especially if

they were originally higher-velocity bank deposits used to pay taxes.

The more that interest payments percolate through the system, the more

they end up with holders who have an increasingly lower propensity to

spend them.

would put the lie to the earlier article, "What If Fed Rate Hikes Are Actually Sparking US Economic Boom?", also at Bloomberg.

And September 2019? Extremely important for a number of reasons including a couple that we haven't yet mentioned. Previously:

"Anatomy of the Repo Rate Spikes in September 2019"

A topic of ongoing interest in light of recent events. HT up front to one of the authors, the Fed's R. Jay Kahn.

From The Office Of Financial Research, April 25, 2023....

Also from Kahn et al via the OFR: "Why Is So Much Repo Not Centrally Cleared?" and via the Social Science Research Network: "Hedge Funds and the Treasury Cash-Futures Disconnect"

And on the 2019 repo spike:

"Economist Michael Hudson Says the Fed 'Broke the Law' with its Repo Loans to Wall Street Trading Houses"

At

the time I remember thinking "Oh look, the Fed has a new lending

facility" and moving on to something shiny, not realizing it was a very

big deal. As the old-timers used to say: "Pay attention or pay the

offer."....

"ANALYSIS-U.S. banks face trillion-dollar reverse repo headache"

A Nomura Document May Shed Light on the Repo Blowup and Fed Bailout of the Gang of Six in 2019

"A Closer Look at the U.S. Bacon Situation"

"The Day When Repo Rates Blew Out: Fed Recounts a Fiasco that Occurred as the FOMC Was Meeting, and How it Reacted

"The Federal Reserve's Explanation Of What Happened In The Money Markets In September 2019

For

now this is just a personal bookmark but we may be referring back to

it. What was going on in Q3 and Q4 2019 was a big enough deal that the

Fed felt compelled to publish this little bit of narrative.

What

seems to have happened was that somebody's derivative book got upside

down to the tune of a few trillion dollars (notional, always say

notional) and in addition the contagion through the counterparty daisy

chain was also in the trillions and well, here's the Fed with their

version.

From the Board of Governors of the Federal Reserve System....

....And more to come. We've been picking at this scab for quite a while

and the picture puzzle is only now coming together so dribs and drabs.

And how does this ancient history tie into what's going on in 2022?

Who knows?

I have a feeling that lands somewhere in "the nebulous region between mere suspicion and probable cause"

(LaFave & Israel on U.S. v. Ramsey, 431 U.S. 606 [1977])

that there is some sort of misdirection going on that I'm not understanding.

If

so, any attempt at analysis of Fed policy and market moves by

traditional means, global macro, central bank policy and practice,

market internals such as options gamma etc., etc. is just so much

blather.

And I keep coming back to the 3rd and 4th quarters of 2019 as the period when things were getting very weird.

More to come (maybe)

Trouble In Repo Land—The QE Endgame: A Big Problem Is Emerging For The Fed

"The Fed Is About to Ramp Up Balance-Sheet Shrinkage. It May Get Dicey".

"Red Pill or Blue Pill? Variants, Inflation, and the Controlled Demolition of Society"

Money, Money, Money: "A Self-Fulfilling Prophecy: Systemic Collapse and Pandemic Simulation"

....Follow the money

In

pre-Covid times, the world economy was on the verge of another colossal

meltdown. Here is a brief chronicle of how the pressure was building

up:

June 2019: In its Annual Economic Report,

the Swiss-based Bank of International Settlements (BIS), the ‘Central

Bank of all central banks’, sets the international alarm bells ringing.

The document highlights “overheating […] in the leveraged loan market”,

where “credit standards have been deteriorating” and “collateralized

loan obligations (CLOs) have surged – reminiscent of the steep rise in

collateralized debt obligations [CDOs] that amplified the subprime

crisis [in 2008].” Simply stated, the belly of the financial industry is

once again full of junk.

9 August 2019: The BIS issues a working paper

calling for “unconventional monetary policy measures” to “insulate the

real economy from further deterioration in financial conditions”. The

paper indicates that, by offering “direct credit to the economy” during a

crisis, central bank lending “can replace commercial banks in providing

loans to firms.”

15 August 2019: Blackrock Inc., the world’s most powerful investment fund (managing around $7 trillion in stock and bond funds), issues a white paper

titled Dealing with the next downturn. Essentially, the paper instructs

the US Federal Reserve to inject liquidity directly into the financial

system to prevent “a dramatic downturn.” Again, the message is

unequivocal: “An unprecedented response is needed when monetary policy

is exhausted and fiscal policy alone is not enough. That response will

likely involve ‘going direct’”: “finding ways to get central bank

money directly in the hands of public and private sector spenders” while

avoiding “hyperinflation. Examples include the Weimar Republic in the

1920s as well as Argentina and Zimbabwe more recently.”

22-24 August 2019:

G7 central bankers meet in Jackson Hole, Wyoming, to discuss

BlackRock’s paper along with urgent measures to prevent the looming

meltdown. In the prescient words of James Bullard, President of the St Louis Federal Reserve: “We just have to stop thinking that next year things are going to be normal.”

15-16 September 2019:

The downturn is officially inaugurated by a sudden spike in the repo

rates (from 2% to 10.5%). ‘Repo’ is shorthand for ‘repurchase

agreement’, a contract where investment funds lend money against

collateral assets (normally Treasury securities). At the time of the

exchange, financial operators (banks) undertake to buy back the assets

at a higher price, typically overnight. In brief, repos are short-term

collateralized loans. They are the main source of funding for traders in

most markets, especially the derivatives galaxy. A lack of liquidity in

the repo market can have a devastating domino effect on all major

financial sectors.

17 September 2019: The Fed begins the

emergency monetary programme, pumping hundreds of billions of dollars

per week into Wall Street, effectively executing BlackRock’s “going

direct” plan. (Unsurprisingly, in March 2020 the Fed will hire BlackRock to manage the bailout package in response to the ‘COVID-19 crisis’).

19 September 2019: Donald Trump signs Executive Order 13887,

establishing a National Influenza Vaccine Task Force whose aim is to

develop a “5-year national plan (Plan) to promote the use of more agile

and scalable vaccine manufacturing technologies and to accelerate

development of vaccines that protect against many or all influenza

viruses.” This is to counteract “an influenza pandemic”, which, “unlike

seasonal influenza […] has the potential to spread rapidly around the

globe, infect higher numbers of people, and cause high rates of illness

and death in populations that lack prior immunity”. As someone guessed, the pandemic was imminent, while in Europe too preparations were underway (see here and here).

"Stock market valuations don’t ‘reflect the damage ahead,’ BlackRock warns" In

the carefree days of yore I probably wouldn't have taken much notice of

this beyond thinking "ah, big money manager has thoughts." *****

....A look at Chairman Powell's calendar for the period February through

June 2020, when the market went from total collapse, including an

intraday 3000 DJIA-point loss one day in March, actually in the middle

of one of the covid press conferences, to one of the most amazing

recoveries in the last 90 years:

TradingView, DJIA daily, December 2019 - June 2020

Some highlights from the Fed Chair's calendar:

February 19, Wednesday

3:00 PM – 4:00 PM

Meeting with Jamie Dimon, CEO and Jenn Peipszack, CFO, JPMorgan Chase

Location: Anteroom

March 19, Thursday

4:30 PM – 5:00 PM

Phone call with Larry Fink, CEO BlackRock

April 3, Friday

3:30 PM – 3:45 PM

Phone call with Larry Fink, CEO, BlackRockApril 9, Thursday

5:15 PM – 5:30 PM

Phone call with Larry Fink, CEO, BlackRock

May 13, Wednesday

1:30 PM – 2:00 PM

Phone call with Larry Fink, CEO, BlackRock

Of course there is much much more but discerning reader gets the point: Powell forgot to call me!

It appears I may have become a bit obsessed with the events of September 2019 - March 2020.